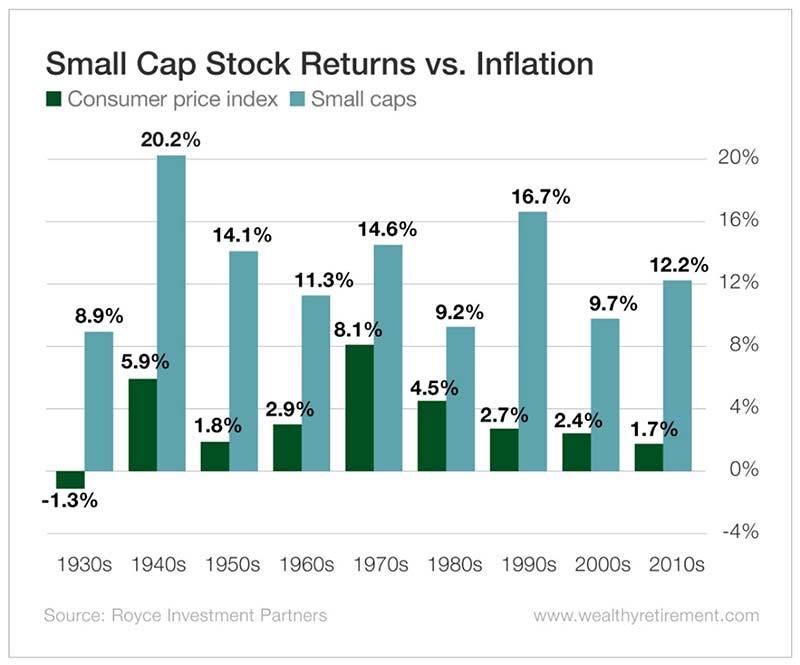

In a recent column, I described how most products in the U.S. became increasingly affordable between 1980 and 2020 when measured in the number of hours worked to pay for them.

However, we saw the biggest spike in inflation in 40 years during the Biden Administration, thanks to massive deficit spending, near-zero interest rates, and the temporary shutdown of the global supply chain.

Yet “time prices” still came down by the end of 2024, extending the long-term trend.

Between 2000 and 2024, the CPI rose 82.2%.

But hourly earnings for blue-collar workers rose 115.1% – outpacing inflation by more than 40%.

That means an hour of work bought 18.1% more goods and services at the end of 2024 than it did at the beginning of 2000.

That’s progress. Just not the kind that the media bothers to cover.

Unlike money, time can’t be counterfeited or inflated.

There is perfect equality here. We all get 60 minutes in an hour and 24 hours in a day.

Our time is truly our most precious resource, the only one that cannot be recycled, stored, duplicated, or recovered.

When time prices decrease – as they have for decades now – an hour of time buys more products and services.

While people often compare what they make with someone earning more, they rarely stop to realize how much more they can buy today compared with what they could buy in the past for the same hours worked.

Time prices are the one unimpeachable standard to compare abundance from one era to another.

And their fall is not due to an increase in material resources. It is due to the expansion of knowledge, which enables us to use resources more creatively and effectively.

This is a powerful phenomenon, yet one that is not commonly understood.

Being able to afford more while working less is further evidence that most Americans are living the Dream without realizing it.

Most of us take the long-term improvement in our standard of living for granted.

Indeed, there is a common misconception that increasing progress and prosperity have been the norm for as long as human beings have been around.

Yet history reveals that this is decidedly not the case.

Imagine, for example, that the Roman statesman Cicero was magically able to time travel and visit Thomas Jefferson at Monticello more than 1,800 years later.

Cicero would arrive at the coast of Virginia the same way Jefferson would have made the trip to Italy.

He would ride a horse to the nearest port and trust his fate to a windblown ship.

When Cicero arrived at Monticello months later, things would look quite familiar.

Jefferson’s home was heated by fire in the winter, and the doors and windows were left wide open in the summer, the same as in ancient Rome.

Jefferson read by candlelight, drew his water from a well, ate mostly what he raised, used an outhouse, and owned slaves, just like Romans did 18 centuries earlier.

Cicero would learn that four of Jefferson’s six children did not survive early childhood.

Nothing new there. This was sadly the case for most of human history.

(Jefferson’s wife died at age 33 of complications from giving birth to their sixth child.)

Except for a few notable innovations – like the printing press, gunpowder, and the compass – life in 1800 was hardly distinguishable from life almost 2,000 years earlier.

Since then, however, there has been an explosion in human progress and prosperity.

Economic historian Deirdre McCloskey calls it the Great Enrichment, a period of exponential wealth creation that started more than 200 years ago and is still accelerating.

This is plainly visible in the quality of your transportation, the speed of your communications, your many laborsaving devices, and the huge variety of goods, services, and outright luxuries available to you at the click of a button.

Thomas Jefferson did not have electricity, cars, trains, airplanes, radio, television, cameras and video recorders, smartphones, computers, lasers, batteries, the World Wide Web, antibiotics, vaccines, pacemakers, artificial hearts, MRI scans, gene therapies, and countless other lifesaving and life-enhancing innovations.

What is most responsible for our exponential increase in abundance?

Two things: freedom and people.

Freedom is crucial because it allows people to create and profit from their innovations.

(That’s why goods and services have not become cheaper for the average consumer in Cuba, Venezuela, North Korea, and other unfree nations.)

But this phenomenon is not about freedom alone. It’s also about more people. A lot more people.

People generate knowledge. Knowledge multiplies output. And freedom lets people share, trade, and profit from their discoveries.

The freer a society, the greater its time price gains. The more people it empowers, the richer its outcomes.

Scarcity didn’t win. Innovation did.

We have increased food supply, for instance, by increasing yields from existing fields.

We’ve increased our agricultural efficiency so much that less than 2% of the U.S. population farms at all.

After more than a century of intensive fossil fuel use, we have more known deposits of oil and gas than ever before.

(And we’ve surveyed only a tiny portion of the planet.)

Overpopulation is not a threat. On the contrary, limiting population growth limits brainpower.

Yet generations of schoolchildren have been taught that population growth makes resources scarcer.

Indeed, academia and the media repeatedly warn us that we are consuming the planet’s natural resources at an alarming rate… and that they will soon be gone.

Not true. Resource abundance is growing faster than the world population.

Our economy has reached such a level of efficiency and sophistication that we are producing an increasing amount of goods and services while using ever-fewer resources.

For example, from 2014 to 2024 U.S. real gross domestic product grew by 27.6%.

But, over the same period, energy consumption decreased by 1.3%.

Western countries have learned how to get the most energy with the least emission of greenhouse gases.

As we climbed the energy ladder from wood to coal to oil to gas, the ratio of carbon to hydrogen in our energy sources fell steadily.

As a result, fewer American cities are now shrouded in a smoggy haze.

Our distant ancestors spent most of their waking hours hunting and gathering food to live.

Yet the typical American today earns their food in a matter of minutes. And we are spoiled for choice at the average supermarket.

We have more goods and services available – and work fewer hours to afford them – than any previous generation.

The world today is incomparably richer than it was in decades past.

Yet the doomsayers are unable to see it – or don’t want to.

Instead, they continually warn us that the end is nigh.

As a result, many Americans are unable to enjoy the countless advantages of modern life because they believe it is on the verge of ending – and there is nothing they can do about it.

Don’t buy it. Especially the claims about “overpopulation.”

The most important resource in today’s world is not oil or natural gas or some rare earth mineral.

It’s people. By applying their intelligence and creativity, individual men and women make other resources more abundant.

Additional people don’t just create additional demand. (Although that also promotes growth and prosperity.)

They represent an additional supply of ideas, knowledge, and productive work.

We shouldn’t underestimate the power of this. Or what time prices tell us.

When you spend less time laboring to feed and clothe your family, put a roof over your head, keep the lights on, and pay your bills, you are gaining the ultimate wealth: more time to do what you really want.

This is not just prosperity. It’s superabundance.

And another reason to acknowledge that the American Dream is alive and well – for those with eyes to see it.

The post How Americans Have Achieved Unprecedented Prosperity appeared first on Wealthy Retirement.

]]>

Better understand the market

Better understand the market